- Doodhwala

- Posts

- 💰 2 Tweets → USDC FALLs

💰 2 Tweets → USDC FALLs

PLUS: BIG Crisis Winners

Gm, this is the doodhwala, the only crypto newsletter that won’t lose its peg, like every stablecoin right now. 😢

Here’s what we got for you today:

👇 2 Tweets and USDC Depegs

🥲 BIG Winner of the Crisis

📈 $5.5 billion moves OUT

🛠 Should You Sell Your Crypto?

🍼 Binance is Safe…I think

Stablecoins over the weekend 👇

👇 2 Tweets and USDC Depegs

Over the weekend, USDC, the 2nd largest stablecoin, lost its peg and eventually found it.

Wait, not that kinda peg.

(the only peg we have is doodh pegs btw)

We’re talking about the peg with the US dollar$.

And USDC lost it. But then found it right back. It’s like Virat Kohli with his form. We’re soo glad VK18 is back scoring 💯!

Here’s the weirdest chart timeline you’ll see all week:

(🇮🇳 Standard Time btw)

🗓️ March 11, 5:00 am → $1

🗓️ March 11, 1:00 pm → $0.88

🗓️ March 12, 9:00 am → $0.98

🗓️ March 12, 1:00 am → $0.95

🗓️ March 13, 9:00 am → $0.99 (just before sending this newsletter)

This ☝️ happened because of 2 reasons:

2 Tweets

Massive FUD

Tweet #1

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle)

3:11 AM • Mar 11, 2023

Slight backstory:

USDC is issued by two companies — Circle and Coinbase. But in order to remain stable at $1, Circle holds $1 in reserve for each USDC issued.

So that:

1 USDC = 1 USD.

USDC issued = $40 billion

USD in reserve = $40 billion (right?)

This ☝️ is where the problem began.

On March 10 (Friday) Silicon Valley Bank (SVB) a HUUUUGGGEEE bank in the US pulled a Celsius and said, “Money? Your money? What your money?”

And Circle was a customer of SVB. 😬

This meant that Circle couldn’t withdraw the USD reserves to back USDC.

Just how much was locked?

Out of $40 billion in supply and a peg that fell to 0.88 per USDC, you’d think A LOT was locked up at SVB right? RIGHT?

W R O N G.

Just about $3.3 billion of USDC reserves was locked in SVB. That’s 8% of its reserves. THAT’S IT!!

The bigger concern however, was what Coinbase did.

Tweet #2

After Circle said ~8% of its reserves are locked in SVB, there was a slight unrest, but then Coinbase dropped this 💣🐚:

We are temporarily pausing USDC:USD conversions over the weekend while banks are closed. During periods of heightened activity, conversions rely on USD transfers from the banks that clear during normal banking hours. When banks open on Monday, we plan to re-commence conversions.

— Coinbase (@coinbase)

3:41 AM • Mar 11, 2023

All USDC → USD conversions were halted.

This really caused 💩 to hit the fan.

It’s like if you told me the McFlurry is back. I’m excited! But then, if you told me they’re giving it with the Happy Meals + a Pokemon toy – I’d sell all my crypto and go buy me 2 Happy Meals 😭

(gotta start working on the McDonald’s job application)

But Circle was equally to blame. Their attitude was pretty much “Screw it, it’s the weekend. I’ll deal with it on Monday.” After all, all of this ☝️ happened on a Friday.

This was literally what their Global Head of Policy said:

(check out the last sentence)

We join the calls from policymakers, regulators, investors, businesses and, most of all, people who rely on a well-functioning U.S. banking system as a condition precedent of growing an economy. We will all be smarter on Monday.

— Dante Disparte (@ddisparte)

3:28 AM • Mar 11, 2023

🤣 🤣 🤣

With no info + massive panic, here’s what happened:

USDC depegged

Every stablecoin (besides USDT) depegged

The premium for USDT rose to 10-20% on some exchanges

This pretty much sums it up:

Okay, now what?

Early Monday morning (Indian time), the CEO of Circle Jeremy Allaire said, the $3.3 billion in USD funds held in SVB were transferred out.

*😮💨 sighs in stablecoin 😮💨*

Here are some other highlights from his thread:

100% of USDC reserves are safe

Funds transferred to BNY Mellon Bank

Incoming new banking partner this week

Again, great info but no memes 😭 gotta step up your game Jeremy!!

Doodhwala’s take:

This weekend was quite a ride. 🎢

It started with the doodhwala bois panicking about whether we should swap our USDC at a discount for USDT.

Long story short — We didn’t.

Partly because we felt the $3.3 billion in reserves was too small and Coinbase has $4 billion in cash to “help out” Circle and USDC. 🤷♂️

Partly because we were too lazy to wait for liquidity to come back up on a DEX. 🤣

How was your weekend? Did you swap your USDC or make a profitable stablecoin trade? Let us know. 👀

🥲 DEXs 1 - USDC 0

What’s that famous old Batman saying?

From chaos, rises order DEXs.

Batman was always a crypto bro. Might even be Satoshi himself. 🤷♂️

But what Batman said is turning out to be true in this whole SVB banking crisis.

When USDC started to depeg on Saturday, every Mahesh, Suresh and Venkatesh with USDC in their wallets flocked to Decentralized Exchanges (DEXs).

Why? 😅

To GET THE F*** OUT of USDC. 🤷♂️

And because of this, the DEXs saw HUGE (like really huge!) volumes.

It wasn’t just 1 DEX but almost every DEX went 🚀

Even the dead ones. 💀

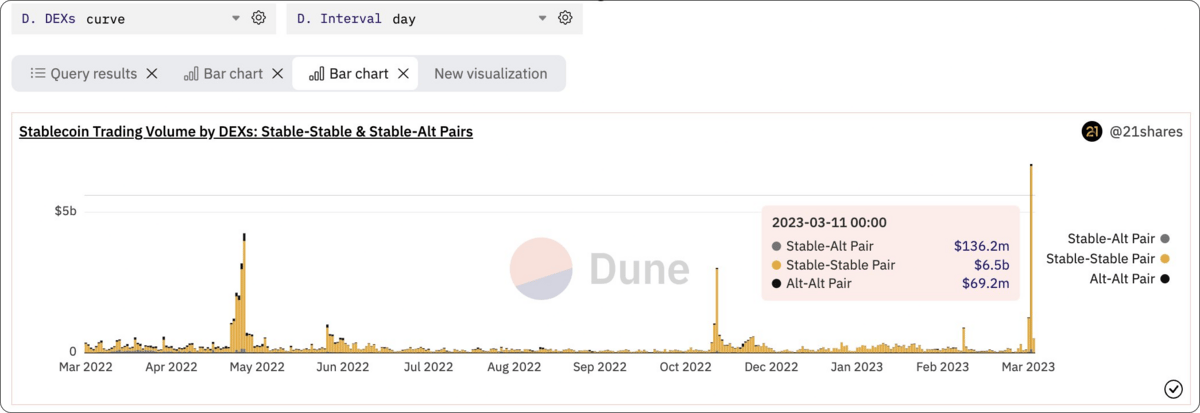

1️⃣ Curve Finance

This is a DEX used by the OG DeFi bros.

The daily trading volume on this platform went all Michael Phelps over the weekend.

🗓 March 1st 2023 → Less than $1 Billion

🗓 March 11th 2023 → ~$7 BILLION

This is highest ever volume in its entire existence so far. 😳

And 97% of the volume comes from Stable-Stable swaps i.e people wanted to move out of USDC to other stables like USDT or DAI. 🤯

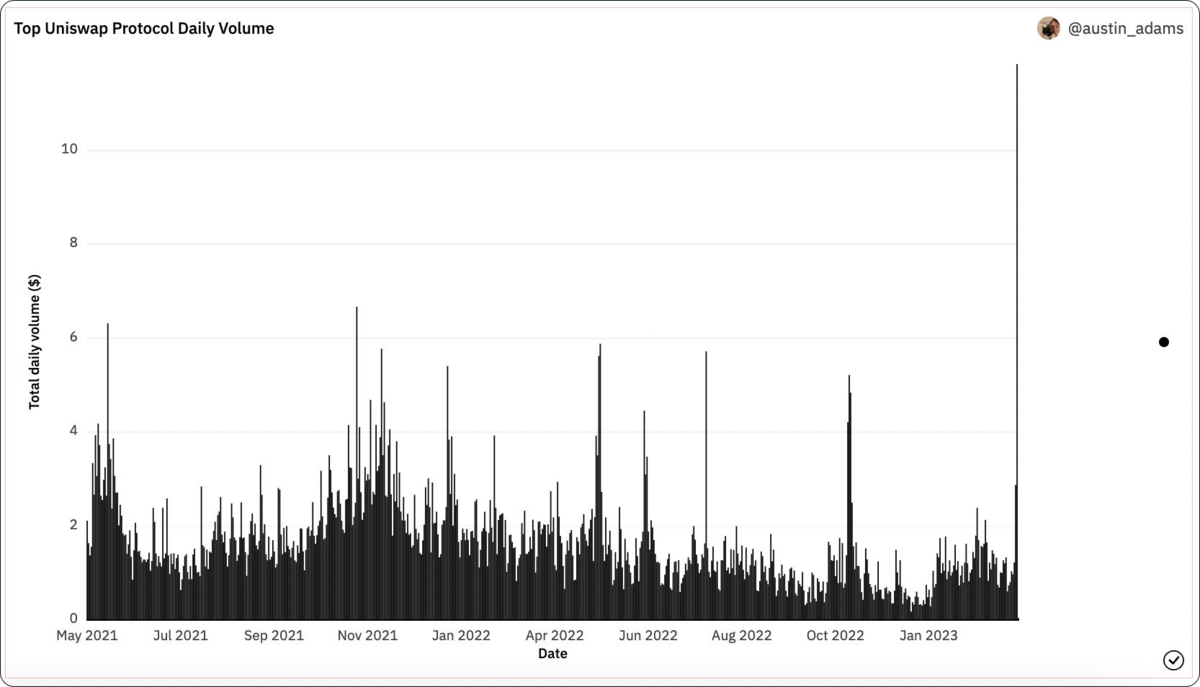

2️⃣ Uniswap

This is the DEX for everyone. (me, my mom, my dad, my granny…everyone!)

So, how did the crisis affect the world's largest DEX?

Same as above. Records were broken, again.

💰 Uniswap’s highest EVER daily trade volume:

👉 Before 11th March: ~6.2 billion (during the FTX crash)

👉 After 11th March: ~11.84 BILLION!

Bruh! That’s almost DOUBLE the volume! 🤯

3️⃣ SushiSwap

This DEX is way past its glory days because of its internal issues. (half the team like sashimi 🤷♂️)

But even this supposed “dead” DEX, saw an uptick. 📈

And it wasn't just in the daily trading volume but also in it’s smart contract usage.

Yup.

SushiSwap was among the most used smart contracts by the BIG WHALES over the weekend. 🐳

This is probably because the whales don’t like change. 😅

They prefer to use what they have been using before.

JUST IN: $SUSHI @SushiSwap one of the MOST USED smart contracts among top 100 #ETH whales in the last 24hrs🐳

Check the top 100 whales here: whalestats.com

(and hodl $BBW to see data for the top 5000!)

#SUSHI#whalestats#babywhale#BBW

— WhaleStats (tracking crypto whales) (@WhaleStats)

4:16 AM • Mar 12, 2023

Overall, the DEX activity reached new heights in every regard this weekend.

But unfortunately, this is for kinda scary reason. 🥲

One of the most widely used and “trusted” stablecoins started losing trust among investors. Thankfully it's back now! 😅

It's kinda like celebrating when your fav football team goes into Champions League finals but all the star players are injured. 😭

So we just have to hold out on cracking the cold doodh bottles open and celebrating. 😬

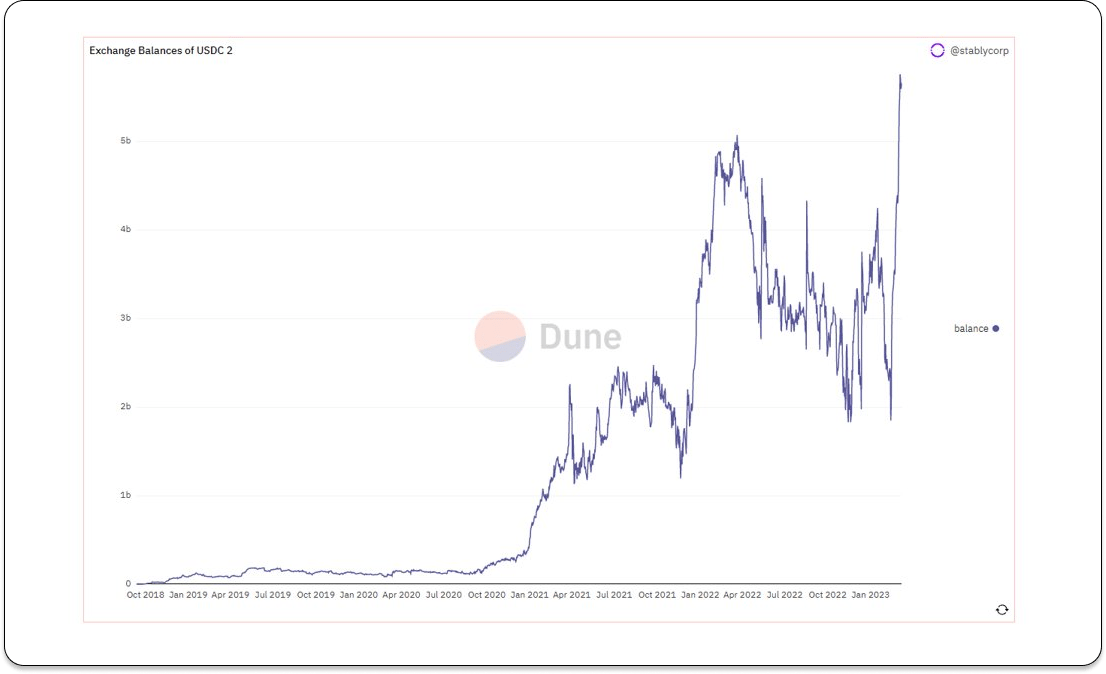

📈 Chaach and Charts: USDC gets thrown out!

Everyone loves milk.

But what’s better than plain milk?

Boiled milk.

But sometimes, if the milk gets tooo 🌡️ it gets burnt.

And no one likes burnt milk.

That’s 👆 exactly what’s happening with USDC right now.

Everyone loved USDC → They bought a TON of it → SVB’s FUD happened → Everyone started dumping their USDC.

And where did they dump it? Exchanges.

Over the weekend exchanges’ USDC balances reached $5.5 billion.

That’s:

🇮🇳 Rs 45,000 crore

👑 240k Bitcoin

♢ 3.4 million ETH

Chegg it 👇

🛠 Resourcewala: Should You Sell Your Crypto?

The recent events might have gotten you a teeny bit worried. (ngl, we crapped our pants a little)

Dark thoughts might be popping into your head rn.

“CeFi > DeFi”,

“Should I sell my crypto”,

“Paani > Doodh” 😰

Well, this is more based on your personal circumstances and we, definitely can’t answer the question for you.

But what we can do is offer a “framework” to think about this.

Today's resource takes you through: 👇

Mindset of selling

The need to sell crypto

The problem with HODLING

The difference between selling stocks

Is it really okay to sell your crypto right now?

So, let’s jump in! 🚀

🍼 Doodhshots: Binance is safe…I think

🔥 Lucky Boy: A Bitcoin miner whose hash rate represented around 0.002% of the network’s total computational power, solves and wins $148k block reward.

⚠️ Hacked Hedera: An EVM-based Layer-1 blockchain, Hedera, saw a hack on its smart contract service code this week and had to pause normal chain activity.

😱 Not A Drill: Another DeFi protocol, MakerDAO, issued an emergency proposal to limit exposure to USDC tail risk after the stablecoin depegged overnight.

💰 Buying in Crisis: Cathie Wood’s Ark Invest picked up another bag of Coinbase shares on Friday, purchasing about $6.4 million of the stock.

😴 Safe And Sound: Binance CEO, CZ, announced recently that the exchange has no exposure to the ded Silicon Valley Bank. Is this the truth or…?

🤣 Milky Meme Of The Day

me checking my $USDC like:

— Doodhwala 🇮🇳 (@DoodhwalaDaily)

6:27 AM • Mar 11, 2023

📢 REFER AND WIN some doodhwala merch 📢

For the first time evaaa, we're giving away the doodhwala merch.

But it's not lame t-shirts with some random company name, but super cool stuff like:

😜 stickers – for your 💻, 📱 and 🚽

📘 notebooks – to write your crush's name

🍺 mugs – for your doodh, and NOT your beer!!

👕t-shirts – with totally non-controversial things (promise 😉)

🧥 hoodies – because we wanna keep you warm in the crypto 🥶 winter

🎁 mystery box – with some super cool prizes that’s worth more than 1 Bitcoin

Chegg it 👇

For every confirmed referral (i.e. they confirm their email and drag it to their “Primary” tab from their “Promotions” or “Updates” tab) you’ll get some 🤤 merch.

All you gotta do is share the doodhwala with this link (only available on email, not on web view) 👇

That’s all for today bhaiyo aur bheno! Naale Sigona! Aakash "Dahi Cheeni" Athawasya & Arvind "Doodh Peda" Krishna

Yo! Our legal and financial advisors (aka our good ol’ conscience) have asked us to add this boring disclaimer. None of what you read here is financial advice. We aren’t here to get you to buy or sell a crypto. We’re only here to tell you what’s up in crypto today and make you laugh. So, if you screwed up on a trade, that’s on you G. Stay safe in the markets.